‘Overly Complex’ New UK VAT Penalties Revision to Hit UK Businesses Next Year

HMRC will enforce a new points-based penalty system for VAT and ITSA from 2022

The system aims to be ‘simple, fair and effective but could be ‘overly complex,’ the ICAEW warns

Soften the impact by getting to grips with the changes as soon as possible

Key Changes to UK VAT penalties

For late submissions, HMRC will be enforcing a points-based system that works similarly to the points systems for drivers’ licences.

If you miss a submission deadline without a reasonable excuse, you will be given a point.

If you reach a specific threshold of points, you will incur a penalty of £200.

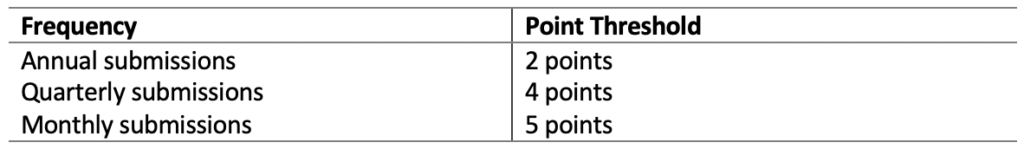

The thresholds depend on how often you submit your taxes:

After reaching the threshold, any additional late submissions will result in further penalties.

Any penalties incurred are in addition to the interest charged on any late payments.

Points are removed after a 24-month period, so if you only get one point during a window it will be removed without consequence. This accords some breathing space for those genuine mistakes that can occur from time to time whilst warning and penalising habitual non-compliance.

VAT and ITSA points are gained and treated separately from one another, and you may appeal against both points and penalties if you feel they have been awarded unjustly.

Penalties for late payments are also set to change – bringing them more in line with other taxes.

There will be no penalty for late payments if you pay within 15 days of the due date.

Between 16 and 30 days after the payment due date, the penalty will be set at 2% of the money owed. From day 30, the penalty is 2% of what was owed at day 15 plus 2% of what is owed at day 30.

After day 31, a second penalty comes into force of 4% per year.

If you have trouble making a payment you owe, you may be able to avoid these penalties by contacting HMRC and setting up a ‘time to pay” agreement. This gives you additional time to pay without incurring penalties.

However, you must set up a ‘time to pay’ arrangement before the 15-day penalty-free period has elapsed. Otherwise, you will be charged a penalty based on the day you set up the agreement. For example, if you set up an agreement on day 16, you will be liable for the 2% penalty.

The Potentially Huge Impact on Businesses

HMRC have said that their intention is to create a tax penalty system that makes sanctions ‘simple, fair and effective.’

However, their chosen revisions have been the subject of intense scrutiny.

The ICAEW (a major body for chartered accountants) has derided the changes, arguing that they are ‘overly complex’ for taxpayers and may in fact make an already difficult to navigate system even denser.

Businesses across the country, particularly SMEs, will likely struggle to adapt to the new regulations and spend much more time on the phone with HMRC than they had previously.

From a monetary standpoint, these changes could have a large cost. Businesses will have to train staff to manage the new system, a potentially lengthy process that will cost time, money and resources.

In conjunction with the plethora of other changes in the works and that have already occurred, such as Brexit, Covid-19 and the Making Tax Digital initiative, many business owners are already struggling to keep up to date with new requirements.

As a result, the problems caused by such a drastic change to the tax penalty system could be compounded even further. The next few years are already expected to be marred with uncertainty and turbulence for businesses, leading some to argue that such alterations should be postponed until a more opportune time.

There is a likelihood that these changes could go unseen amongst business owners’ other priorities, and the ICEAW have warned that the new tax penalty system could ‘catch [taxpayers] unawares.’

However, savvy, forward-thinking business owners will be able to prepare accordingly.

How to Soften the Impact

Although these changes may prove to be beneficial in the long term, the immediate impact of these sudden changes could cause problems for business. This means that it’s important to prepare now to mitigate any issues that may arise.

- Familiarise yourself with the new rules

You can read HMRC’s guidance here for more information. Your planning may involve taking some time to train yourself with the new system and to make your staff aware of the impending alterations.

2. Safeguard yourself against late submissions and payments

If you have a history of late submission and/or late payments, assess your business to find the root cause. By keeping track of any problems you may have and taking actions to reduce the chance of your incurring any points in the new system, you can adapt to the new rules more smoothly.

3. Consider hiring an accountant

You can save yourself a lot of time and energy by hiring a reliable accountant to manage your VAT and ITSA submissions. They will be able to manage the transition between systems effectively and relieve you of the burden of dealing extensively with HMRC. They will have the expertise to navigate this change and others in the future.

Whatever your business, you could be impacted by the new penalty rules so it’s vital to develop a keen understanding of the system before it comes into force.

Kind regards Ilyas