What is Inheritance Tax?

Inheritance Tax (IHT) in the UK is a tax charged on your estate when you die. Your estate is essentially everything that you own including:

- The main residence and any other properties

- Cars, boats

- Jewellery, antique collection

- Life assurance policies, life bonds

- Other investments

The government has set a nil rate band of £325,000. Anything above this amount is charged at an Inheritance Tax rate of 40%.

Residential Nil Rate Band

An additional nil rate band has been introduced on 6 April 2017 whereby you could pass on your residence to direct descendants tax-free. The tax-free amount is being phased in over four years, starting at £100,000 in 2017/18 and rising to £175,000 for 2020/21.

This additional band can only be used in respect of one residential property. It does not have to be the main residence but it must be a residence of the deceased.

What Happens If I Don’t Plan Ahead?

Without Inheritance Tax Planning, your beneficiaries would be left with a large tax bill at the time of your death. However, with advanced planning, you can help ensure that your family or friends will actually benefit from your estate.

If you do nothing to mitigate your Inheritance Tax bill, HMRC could become the largest beneficiary of your estate.

How Much Inheritance Tax Will I Need To Pay?

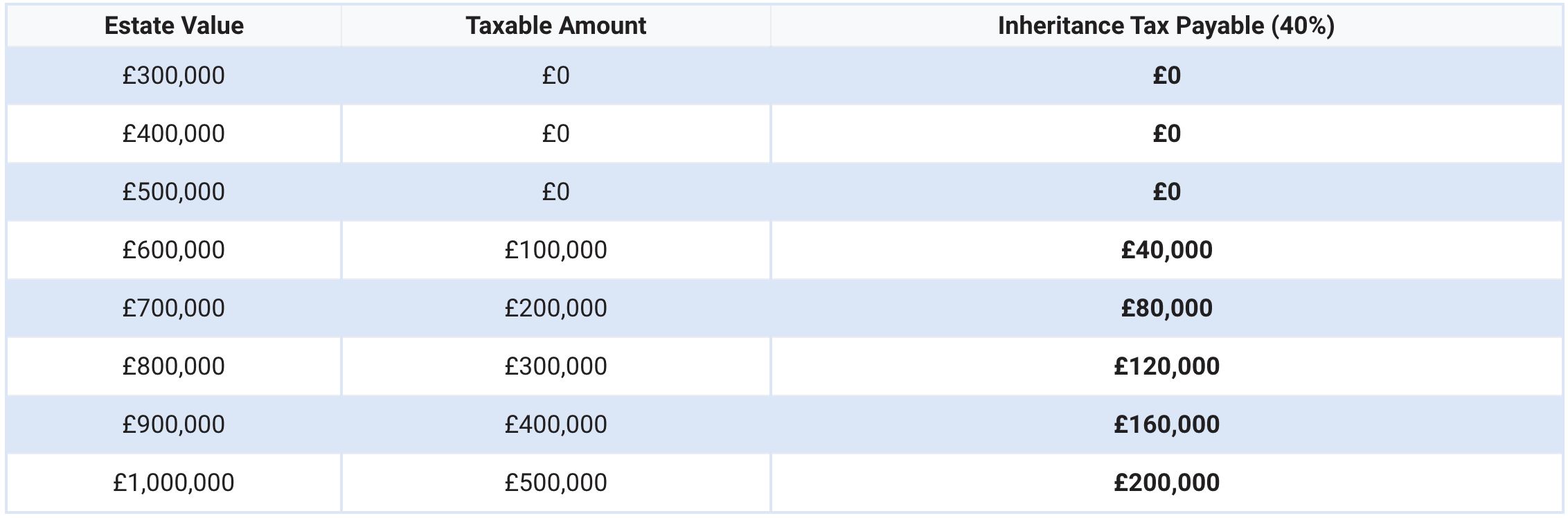

Assuming that your Inheritance tax nil-rate band and residence nil-rate band are available but you do nothing to reduce your Inheritance Tax bill, the Inheritance Tax payable based on 2018/19 would be:

| Estate Value | Taxable Amount | Inheritance Tax Payable (40%) |

|---|---|---|

| £300,000 | £0 | £0 |

| £400,000 | £0 | £0 |

| £500,000 | £50,000 | £20,000 |

| £600,000 | £150,000 | £60,000 |

| £700,000 | £250,000 | £100,000 |

| £800,000 | £350,000 | £140,000 |

| £900,000 | £450,000 | £180,000 |

| £1,000,000 | £550,000 | £220,000 |

Alternatively, you can use our calculator to calculate your Inheritance Tax Bill.

Why Tax Expert?

Ilyas Patel and his team provide long-term solutions so clients can achieve the lifestyle they want for themselves and their loved ones through Inheritance Tax Planning. Unlike independent financial advisers, Ilyas Patel will provide you with the best tax-efficient approach without any unnecessary paperwork and extra charges. Their main objective is to save you money and put you and your family at ease by the time you pass on.

No hidden agenda

We are interested in you and your current situation

Tax Savings

We will adopt the best approach to maximise your tax savings

Knowledge and Expertise

We offer experience, expertise and efficient Inheritance Tax Planning

Inheritance Tax Planning

We will design for flexibility and efficiency

How Can I Reduce My Inheritance Tax Bill?

There are a number of approaches we can help with in order to reduce your inheritance tax bill. Some can be complex and some may be more appropriate than others to your particular set of circumstances. This is why it is important to seek expert tax advice.

Transfer your intended gift to your beneficiaries in a trust

This is useful if your beneficiaries are still young and you don’t want them to inherit until they reach a certain age. You can also retain some control over your capital as they age or get married to safeguard family wealth from divorce.

Ensure your assets are individually

owned by you and your spouse or civil partner up to the nil-rate bands

This is to make sure that each individual can maximise the use of their nil-rate band and avoid going over the threshold limit.

Write a will

By putting a will in place and keeping it updated, you can ensure that your estate will pass on to those you want to, as tax-efficiently as possible, when you die. Without a will, your estate will be dealt with according to the Rules of Intestacy.

Make cash gifts to family and members and use exemptions

You can give away cash or assets up to a total of £3,000 per tax year to family members without incurring Inheritance Tax.

Donate to charities, museums and

political parties

There is no limit to how much and how often you can donate to charities, museums and political parties without incurring Inheritance Tax. This could include family charitable trust.

Utilised deceased spouse or civil partner’s nil-rate band and residence nil rate band

Any unused Inheritance nil-rate band and Residence nil-rate band can be transferred to the surviving spouse or civil partner, assuming the survivor dies after 5 April 2017.

Find Out How Much Inheritance Tax You & Your Family Could Save

What is Inheritance Tax?

Inheritance Tax (IHT) in the UK is a tax charged on your estate when you die. Your estate is essentially everything that you own including:

- The main residence and any other properties

- Cars, boats

- Jewellery, antique collection

- Life assurance policies, life bonds

- Other investments

The government has set a nil rate band of £325,000. Anything above this amount is charged at an Inheritance Tax rate of 40%.

Residential Nil Rate Band

The tax-free amount was phased in over four years, and started at £100,000 in 2017/18. It rose to £175,000 for 2020/21. Since then, it has remained at £175,000, and will until at least 2025/26.

This additional band can only be used in respect of one residential property. It does not have to be the main residence but it must be a residence of the deceased.

What Happens If I Don’t Plan Ahead?

Without Inheritance Tax Planning, your beneficiaries would be left with a large tax bill at the time of your death. However, with advanced planning, you can help ensure that your family or friends will actually benefit from your estate.

If you do nothing to mitigate your Inheritance Tax bill, HMRC could become the largest beneficiary of your estate.

How Much Inheritance Tax Will I Need To Pay?

Assuming that your Inheritance tax nil-rate band and residence nil-rate band are available but you do nothing to reduce your Inheritance Tax bill, the Inheritance Tax payable based on 2018/19 would be:

Alternatively, you can use our calculator to calculate your Inheritance Tax Bill.

Why Tax Expert?

Ilyas Patel and his team provide long-term solutions so clients can achieve the lifestyle they want for themselves and their loved ones with Inheritance Tax Planning. Unlike independent financial advisers, Ilyas Patel will provide you with the best tax-efficient approach without any unnecessary paperwork and extra charges. Their main objective is to save you money and put you and your family at ease for when you pass on.

No Hidden Agenda

We are interested in you and your current situation

Tax Savings

We will adopt the best approach to maximise your tax savings

Knowledge and Expertise

We offer experience, expertise and efficient Inheritance Tax Planning

Inheritance Tax Planning

We will design for flexibility and efficiency

How Can I Reduce My Inheritance Tax Bill?

Transfer your intended gift to your beneficiaries in a trust

Make cash gifts to family and members and use exemptions

Ensure your assets are individually owned by you and your spouse or civil partner up to the nil-rate bands

Donate to charities, museums and

political parties

Ensure to write a will for financial peace of mind.

Utilised deceased spouse or civil partner’s nil-rate band and residence nil rate band

Find Out How Much Inheritance Tax You & Your Family Could Save