LAND REMEDIATION RELIEF

Revitalising Brownfield Sites

Land Remediation Relief (LRR) is a valuable incentive for businesses in the UK, aimed at revitalising brownfield sites. This relief supports companies undertaking the costly process of bringing contaminated or derelict land back into productive use.

Tax Benefits for Your Business

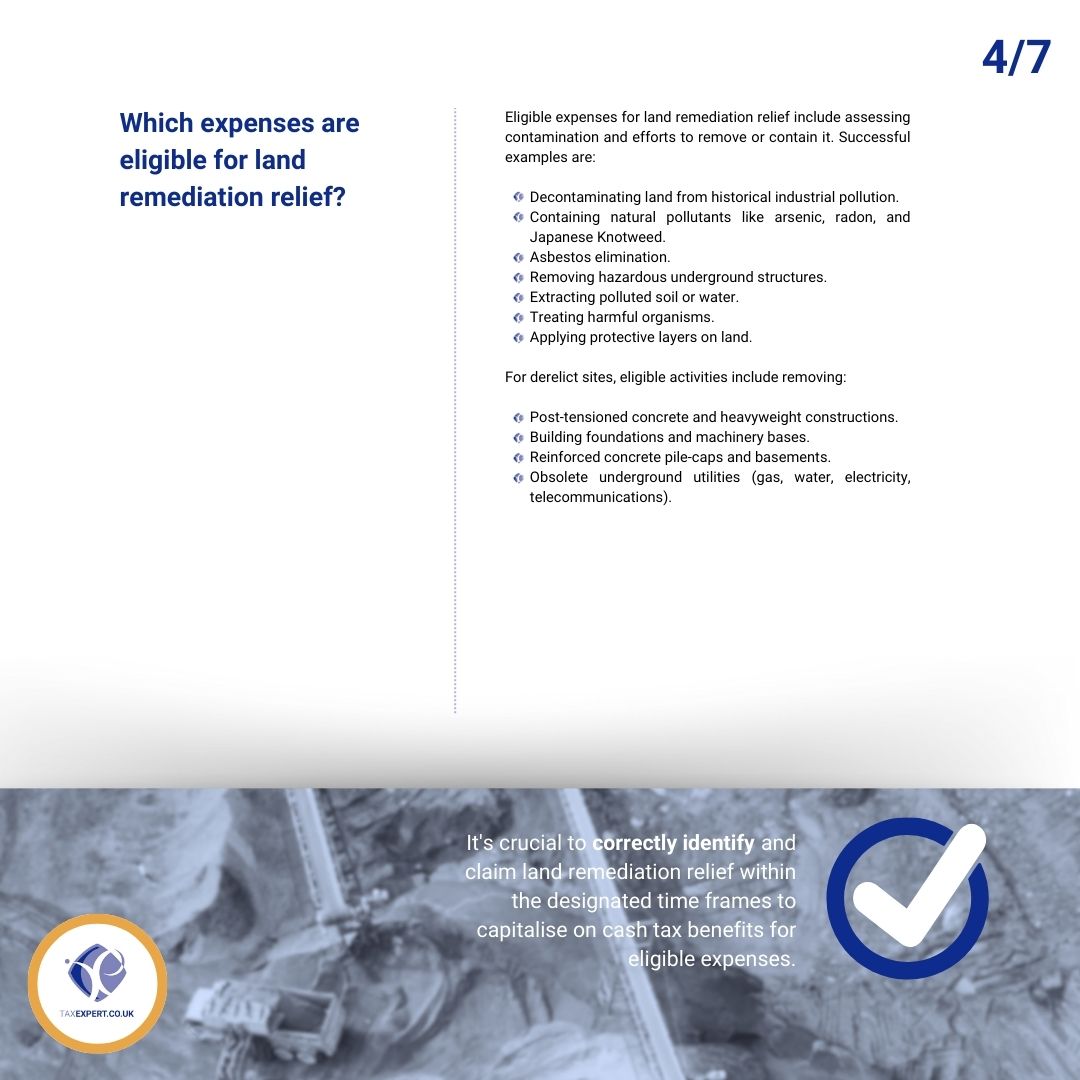

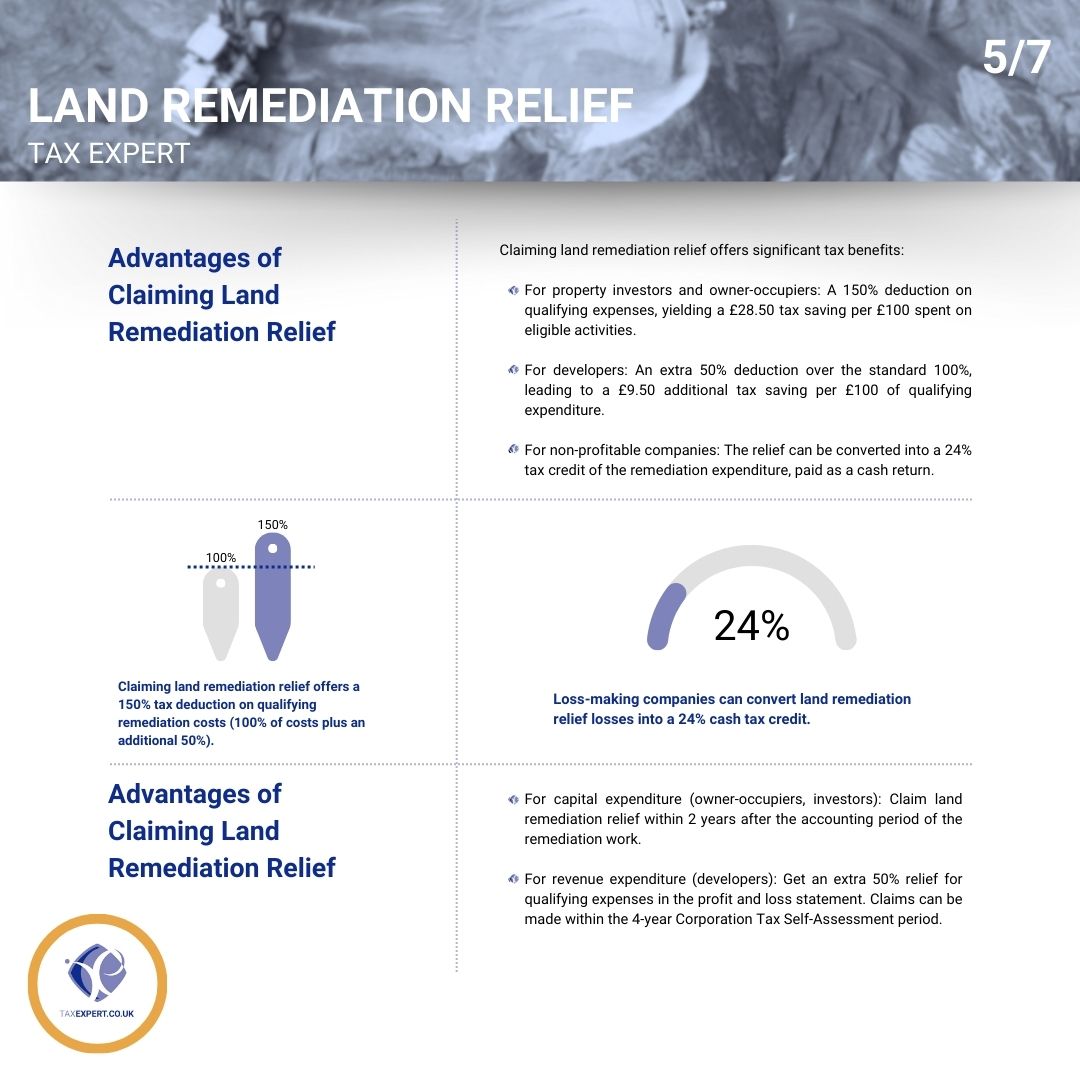

Eligible businesses can benefit significantly from LRR, which offers up to 150% tax relief on qualifying expenditures. This includes costs associated with removing contaminants like asbestos, radon, and Japanese knotweed, or dealing with long-term derelict land issues.

How We Can Help

As your accounting partners, we provide expert guidance in navigating the complexities of LRR. We assist in identifying qualifying expenditures, ensuring compliance with HMRC requirements, and maximising your tax benefits. Our goal is to support your project’s financial health and contribute to sustainable land development in the UK.

Download Our Informative Land Remediation Relief Leaflet

Gain deeper insights into LRR and how it can benefit your business. Our comprehensive leaflet covers all the essential information, helping you make informed decisions.

Click the button below and start exploring the advantages for your business. It’s just a click away!

Find out more

Looking to explore the benefits of Land Remediation Relief for your business? Our team of dedicated tax experts is here to guide you every step of the way.Contact us today at 01772 788200 to find out more about how we can help, or WhatsApp us out-of-hours at 07787 010190.

Alternatively, fill out the form below to get in touch with us, and we’ll get back to you as soon as possible.

Kind Regards,

Ilyas Patel