Legislation governing Stamp Duty Land Tax (or SDLT) is now full of exceptions, exemptions and reliefs. Which now covers a vast amount of property owners. SDLT can be extremely confusing and you could be one of the hundreds of home buyers that have overpaid.

HMRC’s own SDLT calculators, provided on their websites, are not tailored to consider all the variables that may affect the amount for SDLT due on a transaction. They were forced to clarify to a national newspaper the calculators were merely a guide.

Our team can help you understand SDLT and claim a refund on your behalf, just call us on 01772 788200 or message us Here.

Have I Overpaid On SDLT?

If you answer YES to any of the questions on the right, it is likely that you are eligible for a Stamp Duty Refund.

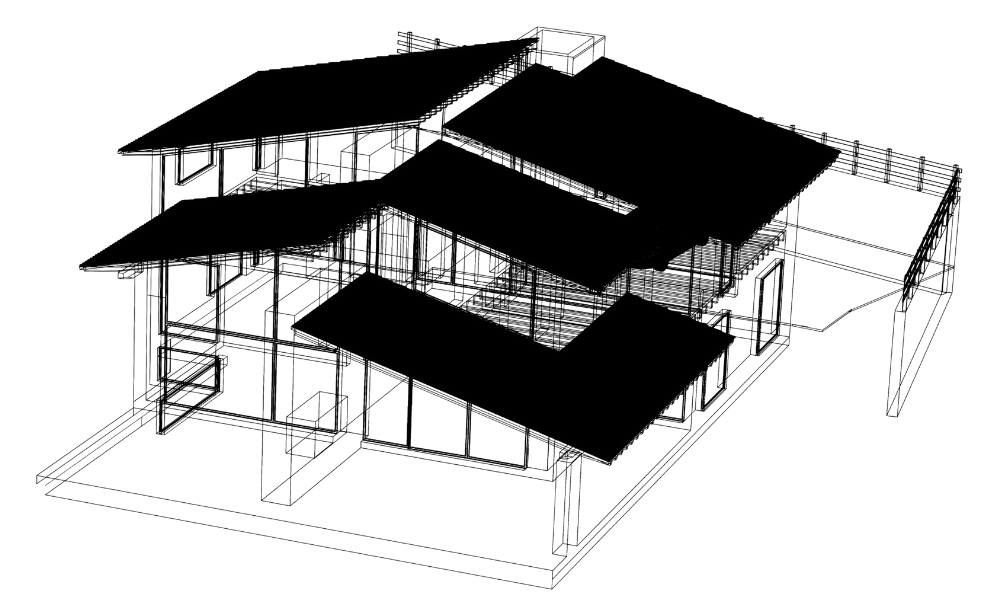

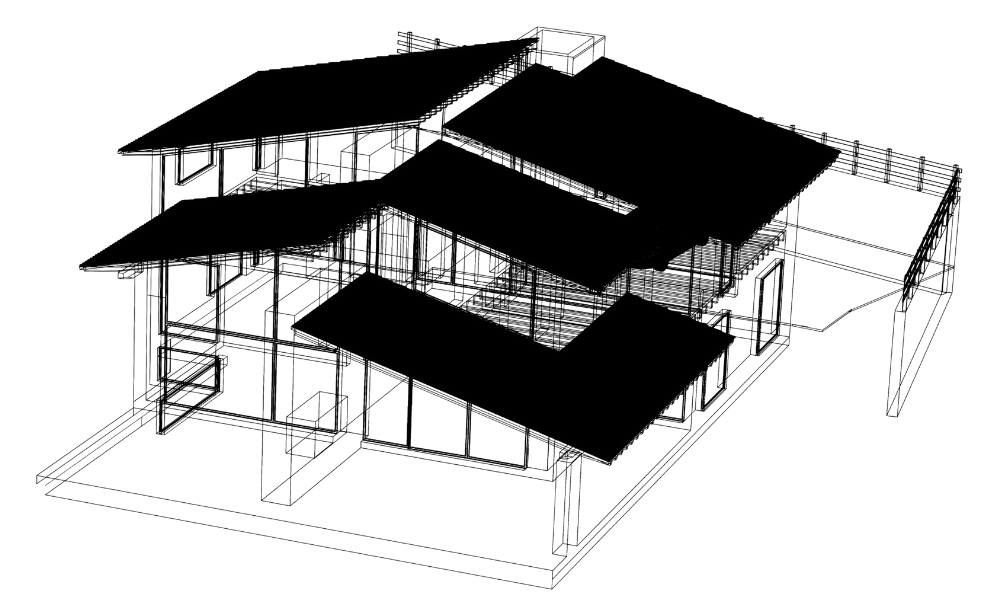

- Has land totalling over half a hectare?

- Has any commercial or non-residential buildings on the land, e.g stables or workshops?

- Has any annexes, flats or cottages on the grounds?

- Came in with any rights over interest in land, that do not benefit the dwelling, for example, commons rights to pass through over nearby parkland?

Why Am I Entitled To A SDLT Refund?

1: YOU HAVE SOLD YOUR HOUSE WITHIN 3 YEARS

Buyers are entitled to a stamp duty refund if they have bought a second home, and paid the 3% additional property stamp duty charge, but gone on to sell their original property within three years.

2: SHARED OWNERSHIP WITH FIRST TIME BUYERS

You may also be entitled to a stamp duty refund if you are a first-time buyer who purchased a shared ownership property for £500,000 or less. In the autumn 2018 budget, the chancellor removed the stamp duty payable on these transactions and made the change retrospective – so it applied to first-time buyers who purchased their homes on or after 22 November 2017.

3: PAID EXTRA STAMP DUTY ON A PROPERTY WITH AN ANNEXE

When the higher rate of stamp duty for second homes was introduced, properties with an annexe, or so-called ‘granny flat’, on their premises were liable for the higher rate – because the main home and annexe were regarded as two separate dwellings.

The rules changed in 2018, meaning such properties are no longer liable for the extra charge – as long as the main building is worth at least two-thirds of the value of the whole property and the annexe is within the main property or its grounds.

However, the new rules were not applied retrospectively. This means you can only claim a refund on transactions, which took place after the change – where your stamp duty was miscalculated based on the old rules.

4: THE PROPERTY HAS UNINHABITLE BUILDINGS

If you bought a second property, which was unfit to live in, with a view to renovating it as a buy-to-let investment, you may have been charged the stamp duty surcharge. Following a legal test case, people who paid the higher rate may be eligible for a refund. If this applies to you, contact us about how to proceed.

Why Use Tax Expert for SDLT Returns?

Ilyas Patel and his team are specialists in property tax. He and his team are not only financial experts but they are also equally well-informed when it comes to Stamp Duty refund claims, so no one is better equipped to find out if you’re eligible.

100% Claim Success Rate

We will assess your eligibility from the beginning

No win, no fee claim

You have everything to gain and nothing to lose

Knowledge and expertise

Our Tax Experts are specialists property tax

Easy Step-by-Step Process

Strategised to maximise the value of your claim

SDLT Refund Frequently Asked Questions

1: How far back can I claim A SDLT refund?

Generally, you can claim a Stamp Duty refund within 12 months of the filing date for the SDLT tax return. However, this may be extended depending on the circumstances.

If you are selling your previous main residence within 3 years of buying your replacement main residence, you have 12 months from the date of the sale to claim a refund of the 3% surcharge.

2: What is the minimum purchase price for a home that might be due a refund?

There is no minimum price – for example, someone paying a 3% surcharge on a property costing £300,000 will have overpaid SDLT by £9,000.

Regardless of your purchase price, if you believe you have overpaid SDLT on your property, please get in touch with us today.

3: How long will a Stamp Duty Refund take?

HMRC usually aims to process all refunds within 15 working days of the application, but the process can sometimes take up to 35 working days.

4: What is classed as a habitable building?

Under the housing act of 1967, to be regarded as habitable, a property must have suitable facilities to meet basic needs, such as maintaining hygiene (i.e. a habitable bathroom and toilet) and mean to be able to cook for one’s self (kitchen).

Contact us today to learn more

What is a Stamp Duty Refund?

HMRC’s own SDLT calculators, provided on their websites, are not tailored to consider all the variables that may affect the amount for SDLT due on a transaction. They were forced to clarify to a national newspaper the calculators were merely a guide.

Our team can help you understand SDLT and claim a refund on your behalf, just call us on 01772 788200 or message us here.

Have I Overpaid On SDLT?

If you answer YES to any of the questions on the right, it is likely that you are eligible for a Stamp Duty Refund.

2. Has any commercial or non-residential buildings on the land, e.g stables or workshops?

3. Has any annexes, flats or cottages on the grounds?

4. Came in with any rights over interest in land, that do not benefit the dwelling, for example, commons rights to pass through over nearby parkland?

Why Am I Entitled To A SDLT Refund?

Why Use Tax Expert for SDLT Returns?

Ilyas Patel and his team are specialists in property tax. He and his team are not only financial experts but they are also equally well-informed when it comes to Stamp Duty refund claims, so no one is better equipped to find out if you’re eligible.

100% Claim Success Rate

We will assess your eligibility from the beginning

No win, no fee claim

You have everything to gain and nothing to lose

Knowledge and expertise

Our Tax Experts are specialists in Property Tax

Easy Step-by-Step Process

Strategised to maximise the value of your claim

SDLT Refund Frequently Asked Questions