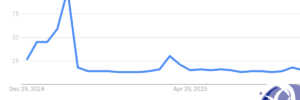

For landlords who have undisclosed rental income, the Let Property Campaign offers a structured opportunity to come forward, declare unpaid tax, and settle what’s owed, without facing the highest penalties or criminal proceedings. Since the campaign began in April 2025, HMRC has recovered around £570 million from residential landlords through voluntary disclosures, with £107 million collected in… Read more »