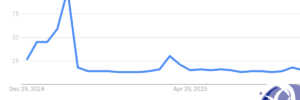

If HMRC is your top search on Google this month, you’re not alone. You are also likely on the verge of paying more tax than necessary. With the right advice, and a few timely steps, you can significantly reduce your January tax bill and avoid unnecessary stress. (Read Time: Approx. 5 minutes) Topics Discussed: Understand… Read more »