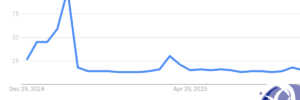

Inheritance Tax was once perceived as a concern primarily for the very wealthy. That perception is no longer accurate. With frozen thresholds and sustained growth in property values, a far broader segment of society now finds itself within scope. Recent figures demonstrate a clear upward trajectory in both HMRC investigations and tax receipts. The financial… Read more »