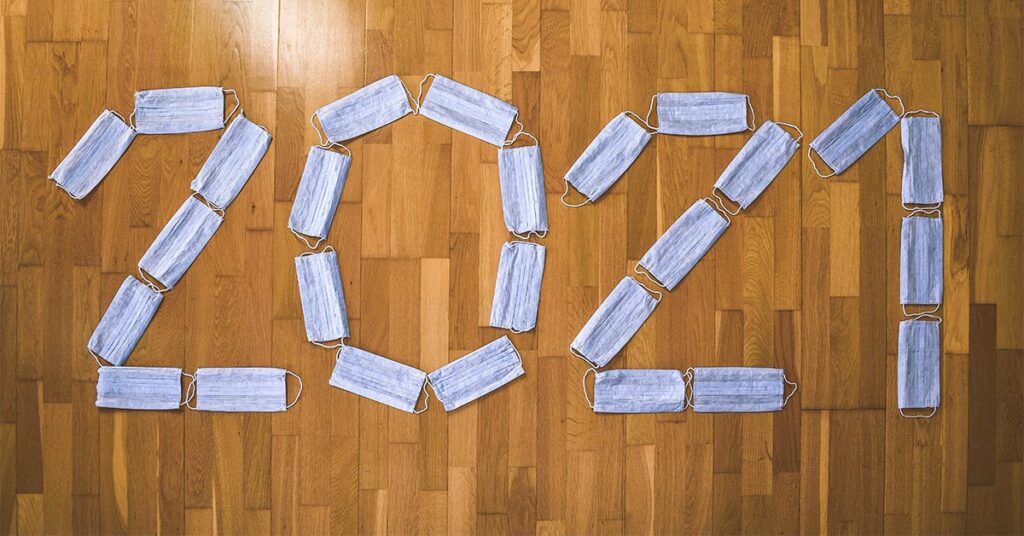

COVID-19 has left an irreversible mark on the world and economy with effects that will last for years to come.

Since the government has issued social distancing measures and lockdown orders to curb the spread of Covid-19, the market has faced unprecedented difficulties that has hit many businesses hard.

The financial and banking sectors have responded by introducing a range of measures meant to support business owners during this time. This comes after heavy recommendation by tax experts UK that the coronavirus would only increase income inequality unless immediate measures were taken.

Employment, travel, retail, shipping, and a number of industries have been gravely disrupted. But there is plenty of support and guidance such as COVID-19 business loans to help people get back on track.

Covid Lockdown Grants

Chancellor Rishi Sunak set forth a £4.6 billion grant for the retail, hospitality, leisure, and other sectors most harshly affected by the pandemic.

Non-essential businesses have been forced to close, but they will be provided with a one-off grant that is worth up to £9,000. COVID-19 support also comes in the form of discretionary funds being used to support disrupted businesses. This is in addition to £1.1 billion being allotted for local authorities and local restriction support grants that offer £3000 every month along with an extension of the furlough scheme.

These top ups are expected to help people recover from the current crisis and benefit more than 6,00,000 businesses all across the UK.

The cash grants are dispensed on a per-property basis and provide benefits of up to £3000 every single month along with an extension of the furlough scheme.

These top ups differ based on the rateable value of the property.

- Businesses with a value of £15,000 or under receive £4000.

- Businesses with a value between £15,00 and £51,000 receive £6000.

- Businesses with a value over £51,000 receive £9000.

For more information, contact your local council to see the options available to you.

Coronavirus Job Retention Scheme (Furlough)

The Coronavirus Job Retention Scheme(CJRS) is an initiative that allows employers to access financial support to pay a portion of their employee’s wages. The purpose of this is to help businesses retain talent that they might be otherwise forced to lay off because of the pandemic.

All employers with staff can claim support under this scheme.

This initiative entails the CJRS paying a portion of a worker’s salary for up to £2,500 per month. Staff that have been previously fired due to COVID-19 since 23 September 2020 can be re-employed and then furloughed.

The business is required to provide payment for the National Insurance Contributions and the pension contributions.

There is no need to pay for the hours an employee hasn’t worked under this initiative. You can use the partial or complete furloughing options to top up your employees wages as you see fit.

While on furlough, your employees cannot do any work that makes money or provides services for your business whatsoever.

This initiative will continue until 30 September, 2021. After June, employers will be expected to pay 10% of the hours the staff don’t work, with that amount increasing to 20% come August and September.

All claims need to be made in advance, and an absolute cap of £2,500 applies every month. Along with claims made with respect of an employee for a minimum seven day claim window.

To start the process, simply

- Identify your employees as furloughed or flexibly furloughed

- Notify them via writing that they are furloughed

- Calculate how much you need to claim using the convenient online government calculator provided here.

Statutory Sick Pay (SPP)

Your employees qualify for SPP if they have been sick and cannot work. This requires them to take more than 4 days off in a row, which includes non-working days.

The first three days are known as the waiting days and require no payment. The fourth day is called the qualifying day and is the day on which you start making payments.

Employees do not qualify if they have worked even a single minute on a day before taking the day off for sickness.

The SPP rates for the years of 2020-2021 stand at £95.85 per week. This caps out at a maximum of 28 weeks.

The SPP rates for the years of 2019-2020 stand at £94.25 a week.

To reclaim SPP, your employees must either have

- Presented COVID-19 symptoms

- Self-isolated because of having to share a household with someone presenting COVID-19 symptoms.

- Been advised to shield themselves

You can ask employees that are shielding to give you a letter from the NHS or their GP stating that they are advised to stay at home.

SPP is earned income that requires payment of income tax and Class 1 National Insurance contributions. You should always consult a Tax Expert to ensure your SPP isn’t causing unwanted ramifications.

This initiative lasts until 30 September 2021.

Deferred Holidays

The government introduced new laws in 2020 to allow employees to carry over four weeks of statutory paid holidays into their next two holiday leave years. This applies to holidays not taken due to COVID-19 related issues.

As part of Coronavirus business support, employers are advised to encourage all workers to take their statutory entitlement to holidays in one year. They will lose the holiday otherwise, and it is especially important during these times to take care of one’s health.

Some businesses might have existing arrangements in place regarding their extra holidays that determine if they can be carried over or not. If they don’t, it’s left entirely up to the employer’s discretion whether to allow extra holiday carry over or not.

Self-Employment Income Support Schemes(SEISS)

In addition, the fourth and fifth Self Employment Income Support Schemes(SEISS) have been introduced as part of Coronavirus business support.

The fourth SEISS grant stands for 80% of trading profits, up to a total of £7,500. This covers the income affected from February 2021 to April 2021.

The fifth SEISS opens in July 2021 and covers the period of May 2021 to September 2021..

This grant also stands for 80% of the trading profits, up to a total of £7,500. But this only applies if turnover is reduced by at least 30%.

If the turnover is below 30%, then you will be entitled to only 30% of your trading profits over this time period.

The online applications must be completed by 31 May 2021 so that HMRC can process the 2019-2020 Self Assessment Tax Returns.

Restart Grant Scheme

The Restart Grant scheme is a one-off initiative that’s aimed at providing support for businesses that are reliant on in-person services for the general public during these difficult times.

Workers in the fields of non-essential retail, hospitality, accommodation, leisure, personal care, and gym sectors are affected under this scheme, as it has come into effect on 1 April 2021.

This scheme comes in two types

- Grants of £6000 aimed at helping non-essential retail businesses

- Grants of £18,000 aimed at helping workers in the hospitality, accommodation, leisure, personal care, and gym fields.

To qualify for this scheme, you business must be listed with premises as a Rate Payer. Local councils are allowed to further limit or change the criteria under which people can qualify for this scheme.

To find out if you qualify, consult your local council for more information here.

Recovery Loan Scheme

The Recovery Loan Scheme(RLS) is a government sponsored loan program. It supports the borrowing of amounts up to £10 million for individual businesses, and amounts of up to £30 million for those in a group.

This initiative was designed to help businesses of all sizes transition through the COVID-19 pandemic safely. It was launched on 6th April 2021, replacing previous government initiatives such as Bounce Back Loans and the Coronavirus Business Interruption Loan Scheme.

Funds acquired through the RLS can be used for any legitimate business purpose. Lenders are provided a guarantee of 80% on losses that arise on facilities of up to £10 million. The government essentially provides 80% of the support. However, you personally assume 100% of the liability in exchange.

Facilities above £250,000 are required to take security. It’s at the lender’s discretion on whether they take any personal guarantees or not.

The maximum length for overdrafts and invoice finance facilities is three years. The maximum length for loans and asset finance facilities is six years.

The RLS initiative is available for anyone that’s previously borrowed under COVID-19 lending schemes. Unlike prior loans, Business Interruption Payments will not be provided to cover interest payments.

You might qualify for this scheme if

- You are trading in the UK

- Your business would be viable if not for COVID-19.

- Your business isn’t involved in collective insolvency proceedings.

You can access the details of this scheme through the government’s network of authorised lenders, such as the BBB.

The British Business Bank and accredited lenders have been asked to administer the government’s coronavirus Business Interruption Loans Schemes to help in funding businesses.

This initiative only runs from 6 April until the end of 2021.