“Setting up a Family Investment Company could ensure your children would avoid higher Inheritance Tax”

What is a Family Investment Company (FIC)?

Family Investment Companies are private limited companies whose shareholders are family members.

They are becoming increasingly popular tools for tax-efficient succession planning because they are structured to grow your wealth whilst allowing you to control your assets. FICs are incredibly versatile and can be adapted to fulfil a variety of needs. They are also a fantastic way to introduce your children to company structures, empowering them with knowledge for their future endeavours.

Why use a Family Investment Company?

1:TAX SAVING AND/OR DEFERAL

Setting-up a FIC involves gifting shares your descendants. As these shares are gifted early on in the company’s life, they won’t have much value at first. This means that you’ll be using up less of your nil-rate band for IHT purposes because their value will increase after they’re no longer yours.

In addition to this, due to the company structure, you won’t retain any benefits on the shares you give away. As a result, as long as you live for seven years after gifting shares to your descendants, the shares won’t be considered part of your estate when you die and won’t be subject to IHT.

2:MANAGE INVESTMENTS FOLLOWING THE SALE OF A BUSINESS

If you’ve recently sold a business, a FIC is well worth consideration as it could be very beneficial.

You may find yourself with a significant amount of assets you no longer need after selling your business. This could include plant and machinery, such as equipment you used to use. These assets can benefit an FIC because you can use them to bring in value for the company. Simply put, any remaining assets left over from the sale of a business can be added to other assets you invest into your FIC.

3:ABILITY TO SPLIT CONTROL AND BENIFICIAL OWNERSHIP

The flexibility of FICs mean that you can split control and ownership according to your specific needs.

Splitting control by having more than one individual possess decision-making authority within the company is often recommended. It allows both parties to easily combine the value of their assets, even assets they owned individually, into shares that are easy to control. This also has the added benefit of ensuring that someone is poised to manage the FIC in the event that something should happen to make one party unable to continue with the company.

Sharing beneficial ownership makes dividing assets much easier for your descendants, as shares are much easier to divide than property. Inherited shares can be worked out with simple percentages rather than the complex sums necessary with dividing physical assets.

4:ABILITY TO CONTROL WHEN VALUE IS PASSED TO FAMILY MEMBERS

One of the biggest selling-points of a FICs is the control they give you over your assets. The nature of the company structure means that you can retain as much of the decision-making power as you wish, ensuring you can continue to protect your wealth.

If you wish, you can gradually change the distribution of shares over time to give your children or grand-children more control over the company. This makes it very easy to appoint someone new to be in charge of the company and can help maintain a FIC for generations to come.

5:AN ALTERNATIVE TO A FAMILY TRUST

Traditionally, when one wanted to leave a sizeable sum to their children or grandchildren, they would set up a trust. However, this has become an unattractive option for many due to changes in tax law from 2006.

FICs are becoming an increasingly popular alternative means of succession planning and are often much more effective way of securing your wealth for future generations of your family. Unlike with trusts, there is no upper limit to how much wealth you can store in a FIC and there is often less tax involved.

How do I set up a FIC?

Starting a FIC is a complicated process and is best left to the Tax Experts

Come visit our brand new offices for a fresh cup of coffee & expert advice

How is a FIC Structured?

As well as enabling you to pass down wealth without an immediate inheritance tax charge, FICs are efficient tax vehicles because the income is subject to corporation tax rather than a personal tax.

Personal tax rates run from 20% – 45% whilst corporation tax is 19%, meaning you could half your tax bill by using a FIC. In addition to this, dividends from a FIC are often tax exempt. Such exemptions don’t apply to individuals.

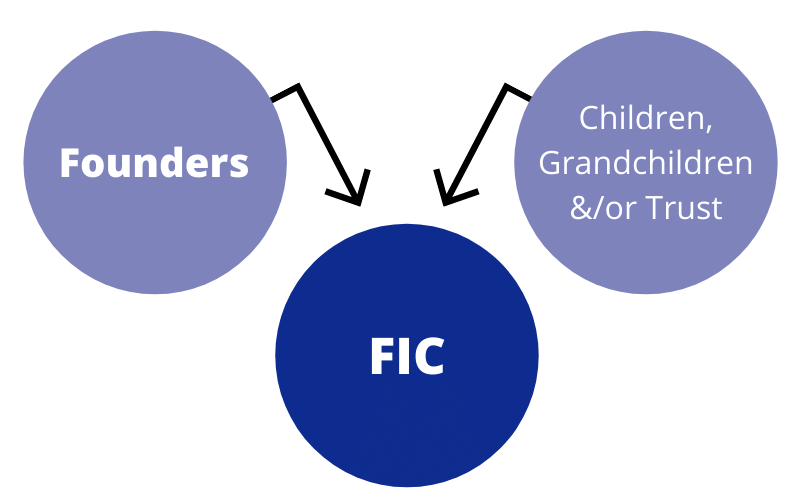

Their structure is fairly simple. Those who set-up a FIC, often parents, have control of the company as shareholders, directors and board members. The beneficiaries, usually their children, have income and capital rights but no decision making authority. This allows the parents to easily pass their wealth along while maintaining full control over their assets.

FICs are particularly efficient when profits are retained in the structure for reinvestment. There will be an additional tax if profits are extracted from the company.

Why Tax Expert?

Ilyas Patel and his team are specialists in setting up Family Investment Companies. He and his team are not only financial experts but also equally well-informed about Family FIC legislation. The team have a culture of ongoing training and development to keep up-to-date with legislative changes in this area.

Knowledge and expertise

Over 40 years of experience in specialist taxation

Easy Step-by-Step Process

No upfront or hidden costs, 100% transparency

Find Out What Our Successful Claimants Have To Say